Wrap-up insurance programs are one of the most popular risk management tools used in today’s construction world. These programs are utilized on every form of project, including residential buildings, stadium projects, and large road and highway civil projects, providing owners, developers and general contractors alike with better insurance coverage and enhanced cost savings.

But what is a wrap-up insurance program and what problems does it solve? In the traditional insurance model for construction, every party involved in a project — the owner, general contractor and subcontractors — is required to obtain and maintain separate insurance coverages to insure their own work. Often times, additional coverage is required to cover the general contractor and the owner for their vicarious liability.

As insurance coverage has become more limited, and the willingness of insurance companies to expand additional insured status to other parties has waned, the traditional insurance model is no longer viable. All too often, accidents occur that are not covered or require extended legal battles that erode limits and fail to help the injured parties. Wrap-up programs eliminate the need for this concern.

Wrap-up Program Basics

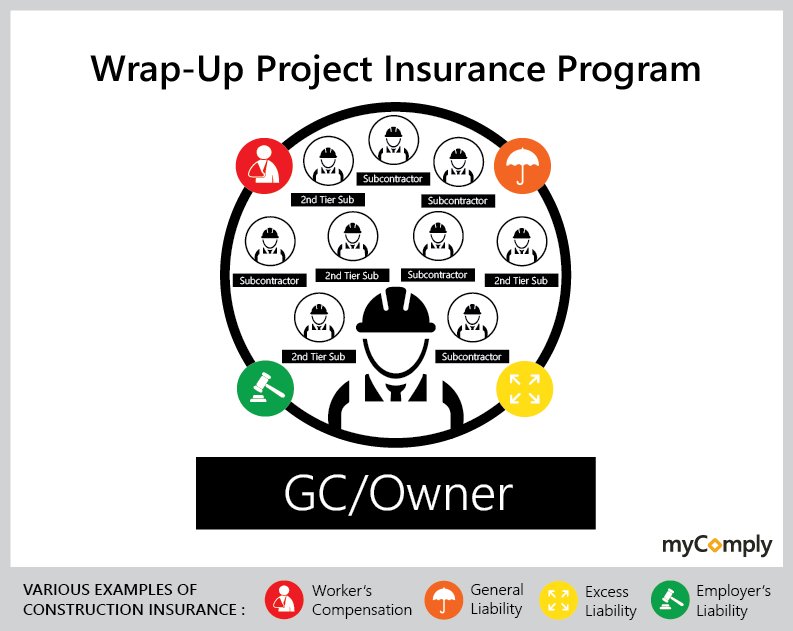

In simple terms, wrap-up insurance programs consolidate insurance, claims and loss control (safety) into one single insurance policy(s) for the benefit of all parties, which include the owner, general contractor and all the subcontractors working on a project site. With one policy (or set of policies) and a single dedicated limit of insurance, a wrap-up insurance program can ensure all parties involved in the project have the right coverage for the duration of construction.

Wrap-up insurance programs can be purchased by both owners (via an Owner Controlled Insurance Program or OCIP) and general contractors (via a Contractor Controlled Insurance Program or CCIP). The types of insurance that can be aggregated under a wrap-up are workers’ compensation, general liability and excess liability. You may also see other lines of coverage purchased for the project, including builders’ risk, environmental/pollution and professional liability.

Expert Management is Critical

Wrap-up programs involve more than purchasing insurance and can get complicated for the owner and construction team. It is up to the owner and general contractor to make sure the insurance purchased meets the needs of all the contractors, and that all claims and safety activities are managed properly. Construction project exposures change every day, with contractors moving on and off the job and new risks being exposed as the project continues towards completion. In the beginning of a project, the owner and general contractor are concerned with setting up contracts that incorporate the proper bidding and insurance requirements. As the project progresses, the construction teams focus on changes and look more at contractor activity at the jobsite, safety oversight and the proper management of claims as they happen. All the while, they are working to complete the project on time and on budget.

This complex process requires management from a strong wrap-up management team. It goes beyond simply tracking sub activity. The team must understand the construction process and be able to interpret activity at the job site and translate it into actionable items. Together, an effective wrap-up management team will be able to do the following:

- Coordinate the contractual language of the owner and/or general contractor to incorporate the wrap-up insurance purchased

- Provide advice and consultation on bidding procedures that owners and/or general contractors can utilize during the bidding process with subcontractors

- Provide cradle-to-grave service to contractors from the time of bidding to the date of final close of their contract

- Provide account management feedback to the owner regarding the success of the wrap-up program.

Coordinating communication and tracking the active contractors on the project site are essential components but can be daunting. The wrap-up management role requires a person savvy in all areas of program management — organized, analytical and a strong listener — with the ability to make decisions and multi-task to help in drive the success of the project.

Activities of Wrap-up Account Management

Once the program is bound, it is the job of the wrap-up management team to take the reins to implement the program by carefully monitoring the program’s success through quality control measures. The account manager carries out the day-to-day activities, including reviewing and approving all subcontractor insurance requirements, verifying insurance costs, reviewing off-site limits and monitoring payrolls.

The wrap-up account manager also educates all parties on the expectation of the wrap-up program, facilitates kick off, stewardship and other training meetings, and develops manuals that detail the program requirements. The wrap-up account manager essentially serves as the middle person for all activities happening on site, and is responsible for building relationships with the onsite construction contacts, claims, carrier and safety personnel, all of whom can impact the results of the program.

These activities are often re-active, but good wrap-up account managers can distinguish themselves by providing proactive insight and analysis that keep a project on track and drive decisions. The wrap-up account manager should be interpreting all of the activity identifying the issues that can be addressed immediately and those that warrant broader discussion with the construction team. Through daily quality control measures, the account manager should identify the baseline, analyze all data points, review claims, flag low or high payrolls, request onsite audits, monitor insurance costs and develop reports showing the status of the program at various milestones throughout the project.

They should measure and monitor all construction outputs to ensure expected criteria is met. The wrap-up account manager should organize supporting documents and provide findings to the client that show the success of the program, or conversely, the problem areas that need to be addressed. By creating benchmarks throughout the program, the administrator can gauge what is expected and where the program is at any given point, avoiding unwelcome surprises.

The best wrap-up account managers also will establish clear lines of communication upfront to facilitate efficient follow up-stream. The onsite project team and owners are not always experts on wrap-up procedures, so establishing the dos and don’ts of account management and providing training and feedback are essential.

For example, we started work on a $600 million project and went through our normal training and orientations with the project staff. After several weeks, we noticed there were subcontractors starting work and not becoming properly enrolled for insurance coverage. Since those subcontractors were not covered under the program, and may not have had their own insurance, this created a potential uninsured risk that could have been a major problem in the event of a claim.

We noticed this problem through our quality control reports. As a team – the owner, wrap-up management team, project team and carrier – we created a plan to refine procedures further, eliminating this risk and were able to assure all contractors were accounted for and appropriately covered under the wrap-up insurance policies.

The wrap-up account management team are the eyes and ears to the sponsor and insurance company that keep projects on track. Wrap-up account management is not glamorous, but being part of a team that builds something from the ground up and being instrumental in helping the moving parts is very exciting. It is amazing to remind yourself what goes into constructing a project, from shovel in the ground to the completion of an amazing piece of construction and to think, the wrap-up management team played a part in making it happen.

Chris Smith is a senior vice president of construction at NFP. Cordia Murphy is a manager of wrap-up administrative services at NFP.